It wasn’t long ago that cash was king. From paying for a morning coffee to tipping a waiter, carrying a wallet full of banknotes was the norm. Fast forward to today, and the landscape has changed dramatically. With the rise of digital payments, contactless cards, and mobile wallets, the world is steadily moving toward a cashless society. Some cities, businesses, and even entire countries are pushing for a future where physical money becomes obsolete. But are we truly ready for this transformation? What are the benefits, and what are the risks? Ever since I started shuttling between two cities (Colombo and London), I can't remember the last time I carried cash with me. All my transactions are via debit or credit card, or Apple Pay where I simply tap and pay!

It wasn’t long ago that cash was king. From paying for a morning coffee to tipping a waiter, carrying a wallet full of banknotes was the norm. Fast forward to today, and the landscape has changed dramatically. With the rise of digital payments, contactless cards, and mobile wallets, the world is steadily moving toward a cashless society. Some cities, businesses, and even entire countries are pushing for a future where physical money becomes obsolete. But are we truly ready for this transformation? What are the benefits, and what are the risks? Ever since I started shuttling between two cities (Colombo and London), I can't remember the last time I carried cash with me. All my transactions are via debit or credit card, or Apple Pay where I simply tap and pay!

The Rise of Digital Payments

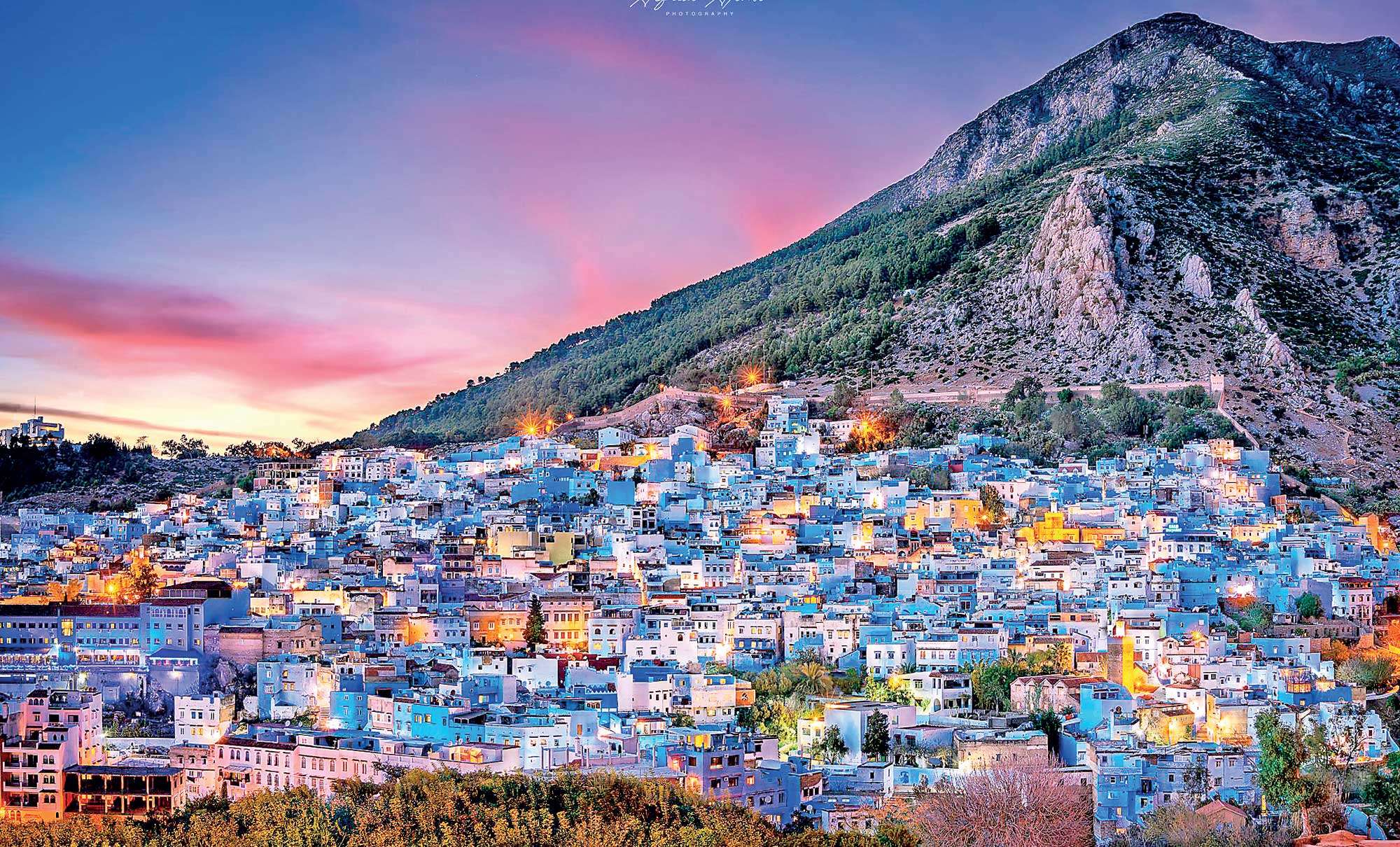

Over the past decade, digital payments have surged in popularity. Innovations like Apple Pay, Google Pay, and Venmo have made transactions faster and more convenient. Credit and debit cards, particularly those with contactless technology, have further reduced the need to carry cash. The COVID-19 pandemic only accelerated this trend, as people sought ways to minimize physical contact, making tap-and-go payments the new norm. Businesses, too, have embraced the digital shift. Many retailers, restaurants, and service providers have gone completely cashless, accepting only card or mobile payments. Some cities, like Stockholm and Beijing, have already become pioneers in this movement, where finding a business that still accepts cash is a rarity rather than the norm.

The Benefits of a Cashless Society

Convenience and Speed

One of the biggest advantages of going cashless is the convenience it offers. Digital transactions are quick and hassle-free. There’s no need to carry bulky wallets, count change, or make ATM visits. With a simple tap, scan, or swipe, payments are completed in seconds.

Security and Transparency

A world without cash significantly reduces the risk of theft and fraud. Unlike physical money, digital payments leave a traceable record, making it easier to track spending and prevent financial crimes. Governments and law enforcement agencies also benefit, as digital transactions help combat money laundering and tax evasion.

Economic Efficiency

Handling cash comes with costs. Printing money, maintaining ATMs, and transporting cash require resources. A cashless economy reduces these expenses, leading to more efficient financial operations. Additionally, businesses benefit from streamlined transactions, reducing the time and effort needed to manage

physical money.

Encouraging Financial Inclusion

While it may seem counterintuitive, digital payments can help boost financial inclusion. In many developing countries, mobile payment systems like M-Pesa in Africa, have provided unbanked populations with access to financial services, allowing them to save, borrow, and transact without traditional banking infrastructure.

The Risks and Challenges

Exclusion of Vulnerable Groups

Despite the benefits, a cashless society raises concerns about accessibility. Not everyone has access to digital banking or smartphones. The elderly, low-income individuals, and rural communities may struggle with the transition, risking exclusion from basic financial transactions.

Cybersecurity Threats

Going cashless introduces new risks, particularly cyber threats. Digital transactions are susceptible to hacking, identity theft, and financial fraud. Large-scale data breaches can compromise millions of users’ financial information, posing a significant risk to personal security.

Privacy Concerns

Unlike cash transactions, which are anonymous, digital payments create detailed financial footprints. This raises concerns about privacy and surveillance. Who has access to our transaction history? How is our financial data being used? Without proper regulations, a cashless system could lead to increased corporate and governmental oversight of personal spending habits.

Dependence on Technology

A fully cashless economy relies heavily on technology and infrastructure. What happens during a power outage, a system failure, or a cyberattack? If digital payment networks go down, businesses and consumers could be left stranded, unable to make or receive payments. Such vulnerabilities highlight the importance of having backup systems in place.

The Risk of Over-Monetization

With digital transactions, banks and financial institutions have more control over how money moves. This could lead to increased transaction fees, affecting small businesses and consumers. Additionally, governments may have more power to impose financial restrictions or even freeze assets, raising concerns about economic freedom.

Are We Ready to Ditch Cash?

The transition to a cashless society is already well underway, but whether we are fully ready remains a question. While many urban populations have embraced digital payments, large segments of society still rely on cash for daily transactions. For a successful transition, governments and businesses must address the challenges of inclusivity, security,

and privacy.

Some countries have already begun implementing policies to ensure that cash remains an option. For example, Sweden, often seen as the most cashless country in the world, has required banks to continue providing cash services to protect vulnerable populations. Similarly, cities like New York and San Francisco have passed laws preventing businesses from refusing cash payments.

A Balanced Approach

Rather than eliminating cash altogether, a hybrid approach may be the best solution. Encouraging digital payments while ensuring that cash remains accessible can help bridge the gap between technological advancement and financial inclusivity. Governments should invest in digital literacy programs, strengthen cybersecurity measures, and enforce regulations that protect consumer rights. Ultimately, the disappearance of cash is not a question of if but when. The challenge lies in making sure that this transition benefits everyone, rather than leaving the most vulnerable behind. As we move toward a digital financial future, the goal should be to create a system that is not just efficient and modern but also fair and inclusive.